Platform Overview

Integrated Finance Platform, explained.

The Integrated Finance (IF) Platform is an orchestration layer built on top of multiple financial infrastructures and products (banks, fintechs, regtechs etc.) to programmatically access boilerplate workflow and integration workloads by:

- Providing automated, customisable, regulatory compliant financial workflows.

- Exposing these workflows via IF API.

- Connecting these workflows to your banks, financial institutions, and other supporting partners/ providers.

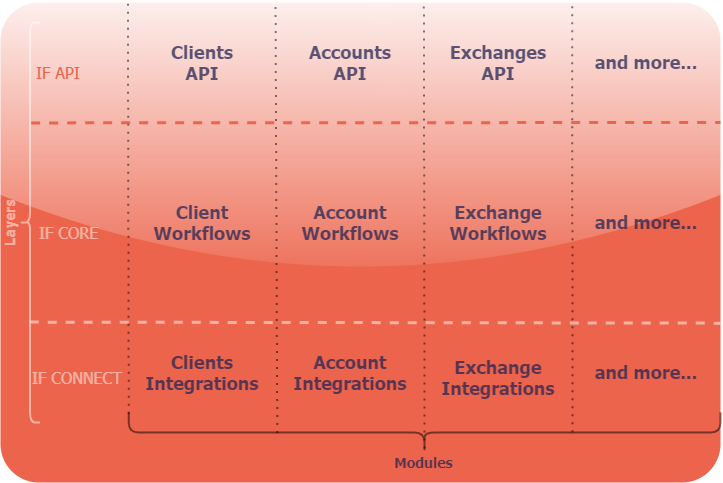

The platform is structured in both layers & modules:

IF Platform Structure

LAYERS

Each message processed by the platform moves through layers:

- The Interface Layer

a. messages arrive via the IF API; - The Workflow Layer

a. messages get processed in the IF CORE; and - The Integration Layer

a. messages get sent to service providers by IF CONNECT where applicable.

Layers are built to give you control over how messages are processed by the platform.

IF API:

The Interface Layer is where your system(s) interacts with the platform. By using the IF API you will be able to:

- Integrate your existing system(s) to the IF Platform

- Build great experiences for your clients

- Leverage the workflows of your choice (e.g. Issuing Accounts, Transfers, Onboarding, Pricing etc.)

- Control how workflows work to optimise your operations

- Connect to the financial infrastructure of your choice

IF CORE:

The Workflow Layer is the layer where standard customizable workflows live in the platform, providing automated flows for the most crucial financial functionality. IF CORE will empower you to:

- add new financial functions quickly to your core offering

- adapt to changing environments (regulations, customer needs etc.) with minimum effort

- execute and automate your financial, treasury and compliance operations without expending technical resource.

IF CONNECT:

The Integration Layer is where the IF Platform connects with the products/platforms of your choice. In order to provide automated financial services the integrations with banks, financial institutions and other providers need to be compliant with regulations and can lead to a requirement to integrate with more products such as CRMs, Screening Products, Monitoring Products etc...). As your business and offering grows, more and more integrations will invade your backlog and distract you from your core offering. IF CONNECT gives you the ability to:

- orchestrate (add/remove/switch) Service Providers on demand

- eliminate the initial cost of integrations to Service Providers

- eliminate the ongoing cost of maintaining integrations to Service Providers

- focus on your core offering instead of maintaining an internal integration hub

MODULES

Integrated Finance consists of different Modules to address different financial solutions. Example modules include, Account Issuing, Incoming/Outgoing Transfers, and Foreign Exchange. A detailed explanation of each module’s capability can be found in their designated documentation.

You will be able to compose your solution by choosing Modules related to your offering.

Some Modules are built on top of other Modules and therefore a general modular dependency concept applies to the IF Platform.

INSTANCES

All Integrated Finance resources you use & create - such as configurations, data processed by Modules etc… - must belong to an Instance. You can think of an Instance as the organising entity for the solutions you're building.

An Instance is made up of the settings, permissions, and other metadata that describe your solution. Importantly, the data processed by one Instance is unique and discrete and is not visible to other instances.

It is possible to create multiple Instances to segregate product offerings.

WORKFLOWS

A workflow defines how a certain message is processed. Each workflow consists of multiple decision points and tasks to carry out. Currently the IF Platform offers pre-built workflows with multiple possible paths for execution. You are able to independently determine the path of execution you need for each API call, or you can configure this at the time of Instance creation.

SERVICE PROVIDERS

Any third party products the IF Platform offers/connects with are referred to as Service Providers such as banks, financial institutions, compliance solutions, accounting products etc... The IF CONNECT layer is responsible for managing how integrations should be used for your processing.

Updated 5 months ago